Get Started With

servzone

Overview

An insurance company license gives a person the right to take and sell insurance items. The State Insurance Commissioner is responsible for issuing licenses for the demand and sale of insurance and is distinguished into various insurance types, including life and disability, health, auto, or worker.’Compensation. A license is required for each particular state residing in a single state and selling insurance in neighboring states. You do not need to take a subsidy from a listed office to get a license, although it is necessary once you plan to work.

Prior to 1999, the Insurance Controller managed the insurance sector of our country under the Insurance Act 1938. But the formation of IRDA has brought significant changes in the insurance sector. Due to the development of IRDA, individuals feel the need for renewal in the field of insurance company licenses. The earlier insurance sector provisions were outdated and next to the point.

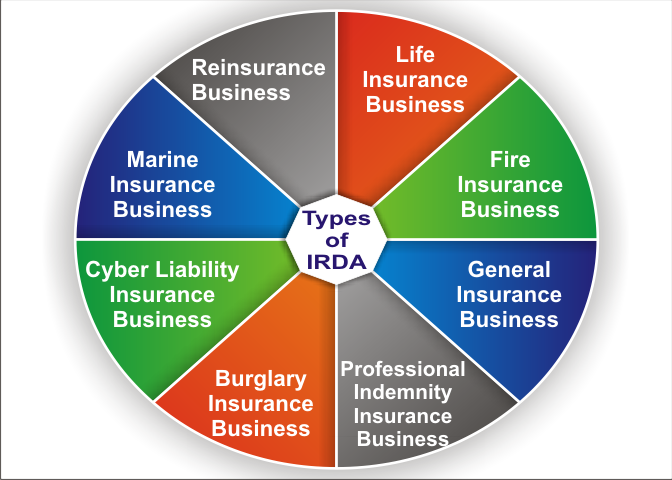

Before applying the license of any insurance company, it is mandatory for all elements to obtain a certificate from the authority. Permits to be obtained for different classes of insurance can be obtained from IRDA, for example life insurance, fire insurance, marine insurance and beyond. In any case, it should be remembered that the life insurance business will not be involved with any other type of insurance business.

Scope of IRDA

- Arrangement of activity to obtain insurance license from IRDA

- The path towards obtaining insurance items approval from IRDA; And

- Procedure for appointment of insurance intermediary.

Registration process

- A candidate may record an application for additional protection or general insurance organization or health insurance business as a whole or for reinsurance business.

- In view of the acceptance of an application, the authority may ask for additional data or clarifications identified with consideration of the application.

- After fulfillment, the authority can give approval and candidate in that point document for another application in the form IRDAI / R2 for certificate of registration.

- The authority can dismiss the application for issuing an order for the registration form by entering the details entered as hard copy.

- A candidate who is denied election shall record an intrigue to the Securities Appellate Tribunal within 30 days of the dismissal correspondence.

Circumstances

- If the authority has refused your registration request

- If foreign investors or Indian investors decide to leave the project for any reason

- Time during the two financial years preceding the expected date for the registration application

- The authority has rejected the application for registration or withdrawn under any condition by the candidate under any condition whenever during two monetary years prior to the date of order for registration;

- If the controlling authority has left your registration certificate,

- In case applicant’s name does not have the word ‘insurance’ or ‘assurance’

Required Documents

Candidates who want to get insurance company license, have to file an application form to IRDAI in the form of IRDAI / R1 to issue the registration application demand.

Documents supporting the application are:

- Applicant is a company formed under the Companies Act 2013

- Certified of MOA and AOA

- Directors details like name, address and occupation

- Certified copy of annual reports of Indian promoters and foreign investors for the last five years

- Certified copy of the shareholding agreement between the applicant's Indian promoters and foreign investors

- Approved by the Board of Directors. Five Year Business Plan

The authority in the wake of getting the application will take into the thought of the nature of insurance items, the degree of actuarial, bookkeeping and other expert specialists in the administration, the association structure. The authority will issue the certificate to the applicant in Form IRDAI/R1 after conducting an inquiry and feeling satisfied. The Authority may dismiss the application in the event they don’t feel contended with the data gave by the candidate for the purpose of obtaining insurance company license.

Gone with the grounds of rejection will be reported to the candidate within thirty days from the day of rejection. A candidate can talk to the SAT within 30 days of receipt of the dismissal order.

The candidate obtaining the certificate of insurance company license has to start his business within 12 months of obtaining the certificate.

Application for registration

When the authority accepts the application for the demand, the candidate will apply in Form IRDAI / R2 to issue a certificate of registration.

Application will contain the accompanying data:

- Application for life insurance / general insurance / health insurance Evidence disposing of value capital is more than Rs. 100 crores or more;

- Application for reinsurance business Evidence is expressing that the settlement value capital is more than Rs. 200 crores or more;

- The affidavit given by the Indian and foreign promoters states that the paid-up equity capital after the initial capital expenditure is sufficient.

- An expression of shareholding having a specific number of shares given to promoters.

- The CEO of Indian developers and foreign investors, MD, WTD stated that the holding of remote payable equity capital is calculated with various principles referenced under the Indian Insurance Companies (Foreign Investment) Rules, 2015.

- FIPB approval if FDI exceeds 26% restriction.

- Certified copy of the published prospectus;

- Certified copy of MOU or any type of agreement between promoters such as management agreement or shareholder agreement or voting agreement or any other type of agreement;

- Confirmation of payment of expenses of rupees five lakhs, which is non-refundable;

- PCA or PCS certificate confirming the consistency of registration fee, value share capital, other demands of the Act;

Suspension of certificate

- Neglect corresponding to the arrangement of identified activities with assessment of benefits and liabilities.

- The insurer is in liquidation or has been liquidated.

- In the case of any other safety net provider without the approval of the authority, the business or class of the guarantor has been transferred or incorporated to an individual.

- Default in consent to the provisions of the Act, or rules or regulations or instructions or orders given by the Authority. After a judgment is delivered in court, any case remains unpaid for more than 3 months.

- The insurer also states the business other than the insurance business or the recommended business.

- Lapse in consent of the Companies Act, 2013, General Insurance Business Act, 1972 or Foreign Exchange Management Act, 1999 or the Prevention of Money Laundering Act, 2002.

- Neglect to pay the annual fee prescribed under the Act.

GST Registration

PVT. LTD. Company

Loan

Insurance